Posted On: March 6, 2024 by Home State Bank in: Personal Banking

As we quickly shift into Springtime, this time of year motivates many to participate in spring cleaning.

But Spring cleaning doesn’t have to stop with your old clothes, shoes, and emptying out that junk closet. Often overlooked, your finances should be added to your spring cleaning to-do list to ensure you’re on track with your goals and making life easier for yourself.

How do you spring clean your finances? Let’s take a look!

- Consolidate Accounts. It’s common for individuals to have their checking and saving accounts in one place, but what about retirement, investment, business, and other accounts? Are you spread across multiple financial institutions? If so, it can be hard to get a clear and complete picture of your financial status. Consider consolidating your accounts under one financial institution, like Home State Bank. If you would rather not, make sure you’re taking time to look at all accounts and tracking your overall financial status.

- Go Paperless. We’re sure one of the items you’re cleaning out this spring is paper and there’s nothing that adds to that clutter quite like your bank statements, bills, and more. Going paperless and using more mobile and online services can keep your home less cluttered and more organized. You can also automate your bill pay to simplify and remove extra steps in your finance routines.

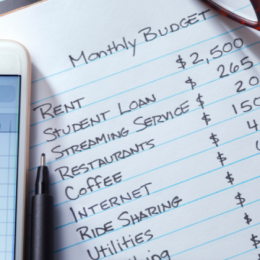

- Review & Adjust Budgets. While the new year can tend to bring on resolutions to better manage your money and budget, people tend to fall off their resolutions by mid-February. Spring is a great time to analyze and adjust your spending and budgets to stay on track.

Consider our Christmas Club and Vacation Club saving accounts.

- Review Bills. In addition to reviewing your budgets above, reviewing your bills, and especially those subscriptions, can be supportive in your financial goals. Many services are now a monthly or annual subscription. Take time to look through what you’re spending and consider removing any that aren’t needed anymore. You may be surprised at what you’re still spending on!

If you’re looking for more ways to save or spring clean your finances, connect with one of our Universal Bankers today to get started!

If you’re looking to get rid of all those paper statements, consider attending our annual Shred Day event coming up on May 15!

.png)

Equal Housing Lender and Member FDIC

0 comments